Every driver needs to find car insurance that meets his budget and the coverage he wants. Comparison of different providers is the most effective way to achieve this. Insurance rates are affected by several factors, such as age, driving record, credit score, and others.

A quick quote can be obtained, though it takes some time. Many resources are available online that help drivers to compare auto insurance providers.

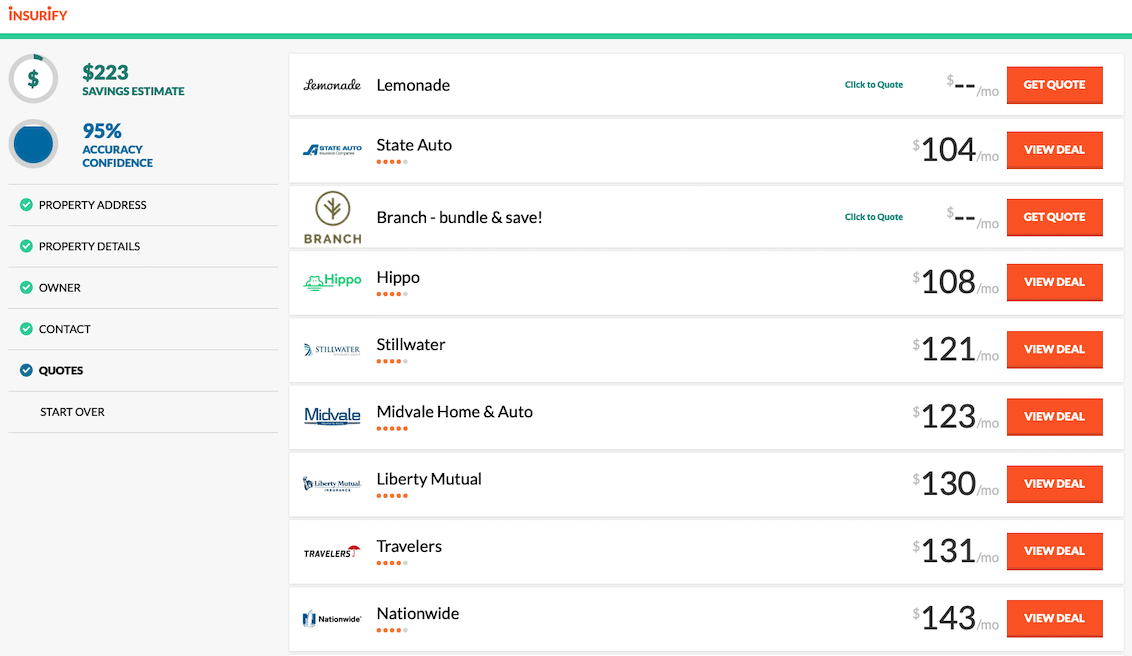

State Farm Geico USAA and other national insurers offer some of the cheapest insurance rates in Austin. These companies have excellent Bankrate scores, and they offer discounts and coverage options that are tailored to different driving situations.

The best company to work with is one that provides the best service. USAA is a good example. It offers great customer service ratings and digital tools. It also offers competitive rates for military members and their families, though it's restricted to those who are current or former members of the U.S. military and their immediate family members.

The type of license you hold and the car that you drive are also important factors. Your insurance may cost more if your driver's license is from an area where there is more traffic. In addition, you might find that a particular company offers lower rates for those who live in a safe area with low crime.

Drivers without any violations can find some of the best rates on car insurance. A DUI conviction or an accident at fault will increase your premiums.

Texas' high auto insurance rates can surprise young drivers. This is because the state has high auto insurance rates.

Regardless of your age, it's always a good idea to shop around for the cheapest auto insurance. By comparing rates from multiple companies, you can save up to 50% on your policy.

Local agencies that offer insurance can provide the best prices in Austin. Some have even their own mobile apps and websites.

Apps that analyze your driving habits can save you money on insurance. They will assign you a rating according to how you handle the road. This helps you save up to $900 a year on your policy by avoiding tickets and accidents.

It is possible to save on your Texas auto policy by using Root. It's a convenient app that keeps track of your driving and assigns you a score, which can help you save up to 5% on your premium. You can manage your information, submit claims and even manage your policies.

Adding a safety device to your vehicle or buying an older car model are other ways to reduce your insurance costs. According to the type of vehicle that you drive, it is possible to save as much as 10%.

Toyota Corollas Nissan Altimas and Volkswagen Jettas offer the best insurance prices. NerdWallet found that these cars have the lowest insurance rates for those with clean driving records.