It is vital to have homeowners insurance in Kentucky. This will protect your most valuable investment, which is your house. You can get affordable homeowners insurance for Kentucky if you are buying a house. This will cover damage caused by vandalism, theft, or natural disasters.

Homeowners Insurance Kentucky: How to Choose the Best Policy

Insurers offer different coverage options, so it's important to find the right policy for your home. Your insurance cost depends on how much your home is worth, what type of house you own and other factors.

Many homeowners purchase extra protections such as flood and earthquake insurance in addition to their basic home policy. The policies do not have to be mandatory, but can help protect your investment if you suffer a loss due to an earthquake or flood.

Average Home Insurance Cost kentucky

To get the lowest rate on homeowners insurance in Kentucky you will need to compare quotes from 3 or more different companies. You'll get the best rate for your situation if you compare quotes from at least three different providers.

Kentucky's average annual home insurance premium is $1,109. The average home insurance cost in Kentucky is $1,109 per year.

Homeowners Insurance Louisville

Louisville homeowners' insurance is very different from other cities. This makes it important to shop around. MoneyGeek looked at quotes from ten of the most popular home insurance companies.

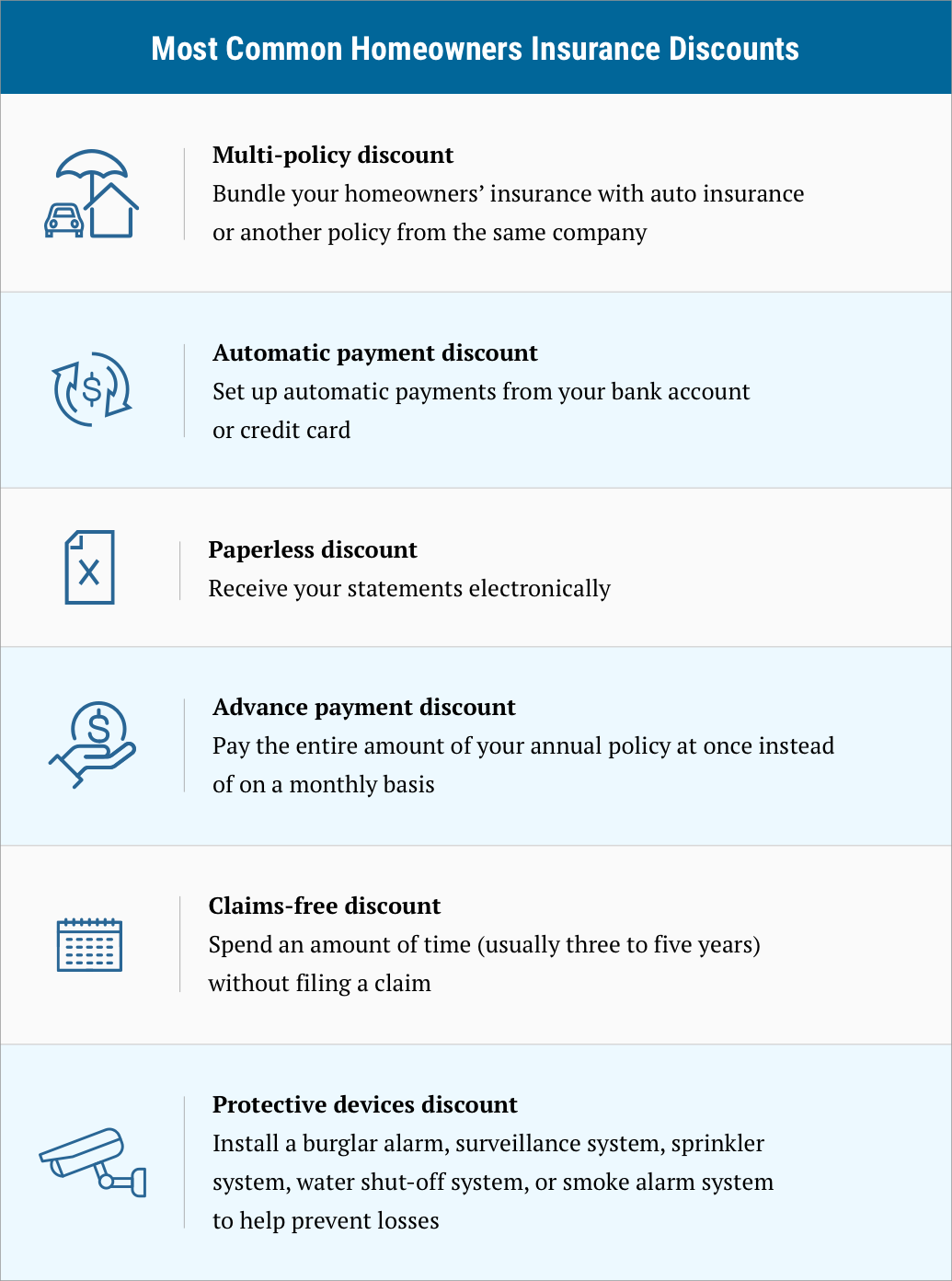

It's also important to take advantage of any discounts offered by your insurer. You may be eligible for a discount if you have a garage or a security system.

Look for an insurance provider that provides excellent customer service. This will make your experience easier and less stressful. You can expect the best insurance providers to be able answer all your questions promptly and accurately, regardless of whether you have a claim.

In addition to home insurance, Kentucky residents may want to consider flood and earthquake coverage. The state is prone to these risks. Be sure your policy covers them.

These policies can cost hundreds of dollars more or less depending on where you live and the risk involved. Insurance companies also offer deductibles. It's important to select one that meets your needs and is affordable.

Aside from these major factors, you should also consider the quality of your policy. Many insurers offer discounts for certain safety features such as burglar alarms and fire detectors.

In addition, your homeowners' insurance should cover the costs of living during repairs to your home. This coverage is also known as loss of use coverage, and it helps pay for your expenses while you're unable to live in your home because it's being repaired.

It's crucial to choose a trustworthy company to provide the right coverage for your home in Kentucky. Allstate and USAA offer great customer service. They are the top choices for homeowners insurance in Kentucky.