Arizona homeowners insurance will protect you, your family and your property from losses due to a wide range of perils. These include fire, natural disasters, theft and more. It covers liability for injuries or damages to other people's properties.

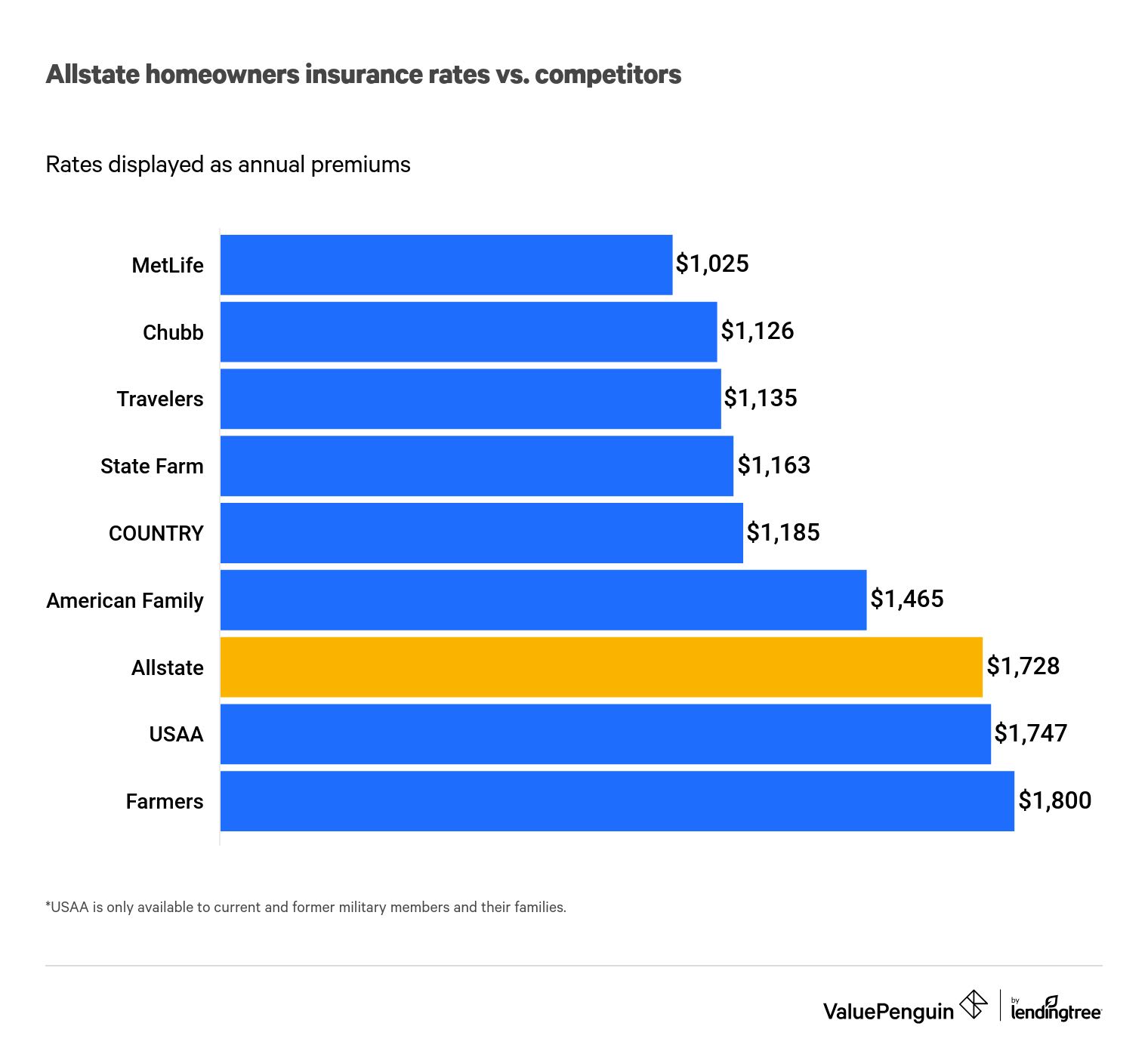

USAA provides the cheapest homeowner's insurance in Arizona. Its average annual rates for a house worth $400K are $1216, which is equivalent to $134 per month.

Compare several Arizona home insurers before selecting one. Some insurance companies have better customer support, while other offer greater flexibility with your coverage. Some offer discounts if you install certain features, such as security cameras.

Review your policy yearly.

Every year, you should review your homeowner's insurance to make sure that it is adequate for the risks you may face. Your agent should be informed of any changes made to the home or landscaping, such as renovations, sprinklers, sheds and pools.

A deductible is something you should discuss with your agent.

The higher your deductible is, the lower you will pay for premiums. For example, if your deductible is $1,000 and your kitchen burns down, you'll pay the contractors who repair the house, but the insurer will cover the rest of the costs.

It is also worth considering purchasing replacement coverage. This will allow you to replace your item at a fair price. It is especially important if your valuables include expensive jewelry, electronics and other valuables.

It's possible that your lender will insist on homeowners insurance when you apply for a loan. Even if you don't have a mortgage, homeowners insurance is still a smart idea to keep you protected in case of any disasters.

Contact your local independent insurance agent and get a quote on the right home insurance for you. You can compare policies and learn about available discounts to lower your homeowners insurance costs.

Shop around for the most appropriate coverage, especially if moving is on your agenda. As the risk of disasters or weather damage is higher in your new neighborhood, it is important to compare home insurance quotes to protect yourself and your investment.

You should also estimate your rebuilding cost. Arizona homes are often severely damaged by hailstorms, monsoon rains, and wildfires.

Mercury agents can protect your home and help you to understand the risks of living in Phoenix, Tucson, or Scottsdale. Your local agent can also provide a free home inspection so that you're aware of the risks to your property.

Do you want to buy a home in Arizona?

When moving to Arizona, you should make sure you get the right homeowners' insurance. Having the proper coverage in place can save you thousands of dollars in the long run.

Are you worried about the cost of your home insurance?