People who travel for a longer period of time, such as digital nomads or backpackers, will benefit from long-term travel insurance. The policy can last up to 18-months. Many companies also offer optional coverage for watersports and adventurous activities.

It's vital to carefully read the fine print when purchasing long-term travel coverage. This will help you understand what is and isn't covered. You may not get coverage if you already have a medical condition. So, make sure you disclose this when you apply.

You can also opt for cancel-for-any-reason (CFAR) coverage, which will reimburse you a percentage of your trip costs if you have to cancel your trip due to an approved reason such as an illness or death in the family. This option is available as either a standalone policy or as a rider to an existing comprehensive policy.

If you have a chronic illness or an injury, it's best to purchase a policy that offers emergency medical and evacuation coverage. It will pay to transport you home or to hospital if your travels are interrupted by illness or injury.

Some companies will also reimburse you for flight changes that occur because of a delay in your schedule, such as if you miss a connection or need to wait for a delayed flight. This coverage can be helpful for long-term travel who have to change their plans constantly.

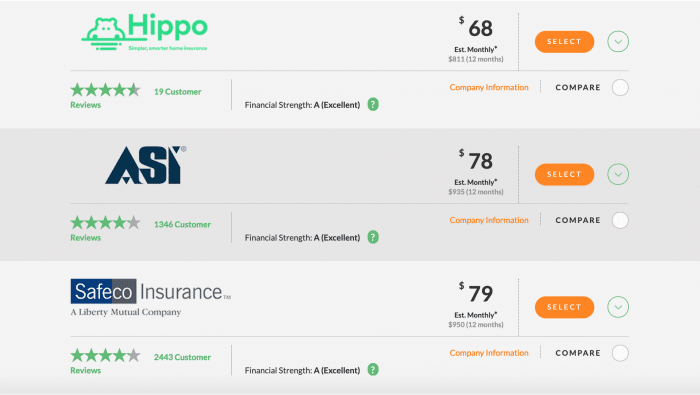

It is a good idea for you to choose a plan with a small deductible. This way, in case of emergency, you will not have to pay any extra expenses. Many policies have a high deductible. You'll need to shop around and find the best rate.

Choose a travel insurance provider who offers excellent customer service. This will give you confidence in your decision and help you get the care you need if you do experience an emergency while travelling.

Allianz is the leader in the industry and has been for over 55 year. This is due to the financial strength that Allianz SE, its parent company, possesses. Travel health insurance is a trusted brand that offers global coverage to millions of people each year.

In order to avoid costly medical expenses, you should purchase a travel insurance policy. You also want to be covered in case of illness or accident abroad. These policies often include a 24-hour emergency hotline that can connect you with a doctor or attorney if you fall ill abroad.

Depending on the policy you choose, it may also include other benefits such as emergency medical treatment and return of mortal remains coverage. It's best to speak to a travel health insurance specialist who can guide and advise you on the most appropriate policy.