Buying homeowners insurance is one of the best ways to protect your home, your belongings and your finances. You can avoid costly legal fees if you're sued for damages.

There are some steps you can follow to make the process easier and less stressful. Start by learning about different kinds of homeowners insurance and their features. Consider the factors that influence your premium.

What are your limits and coverage?

Your policy for home insurance should be well-written and cover all your belongings. This means that you should protect your property against fire, theft, wind and other perils. You may be covered for damage caused by certain natural catastrophes like floods or earthquakes depending on your coverage and deductible.

Understanding your insurance policy's coverage limits is important before you file a claim. This will help you determine the amount of money you need to replace your lost property. It is important to understand your policy and coverage limits before filing a claim so you know how much money you'll be able to afford to replace your property after a loss.

Find a low-cost home insurance policy

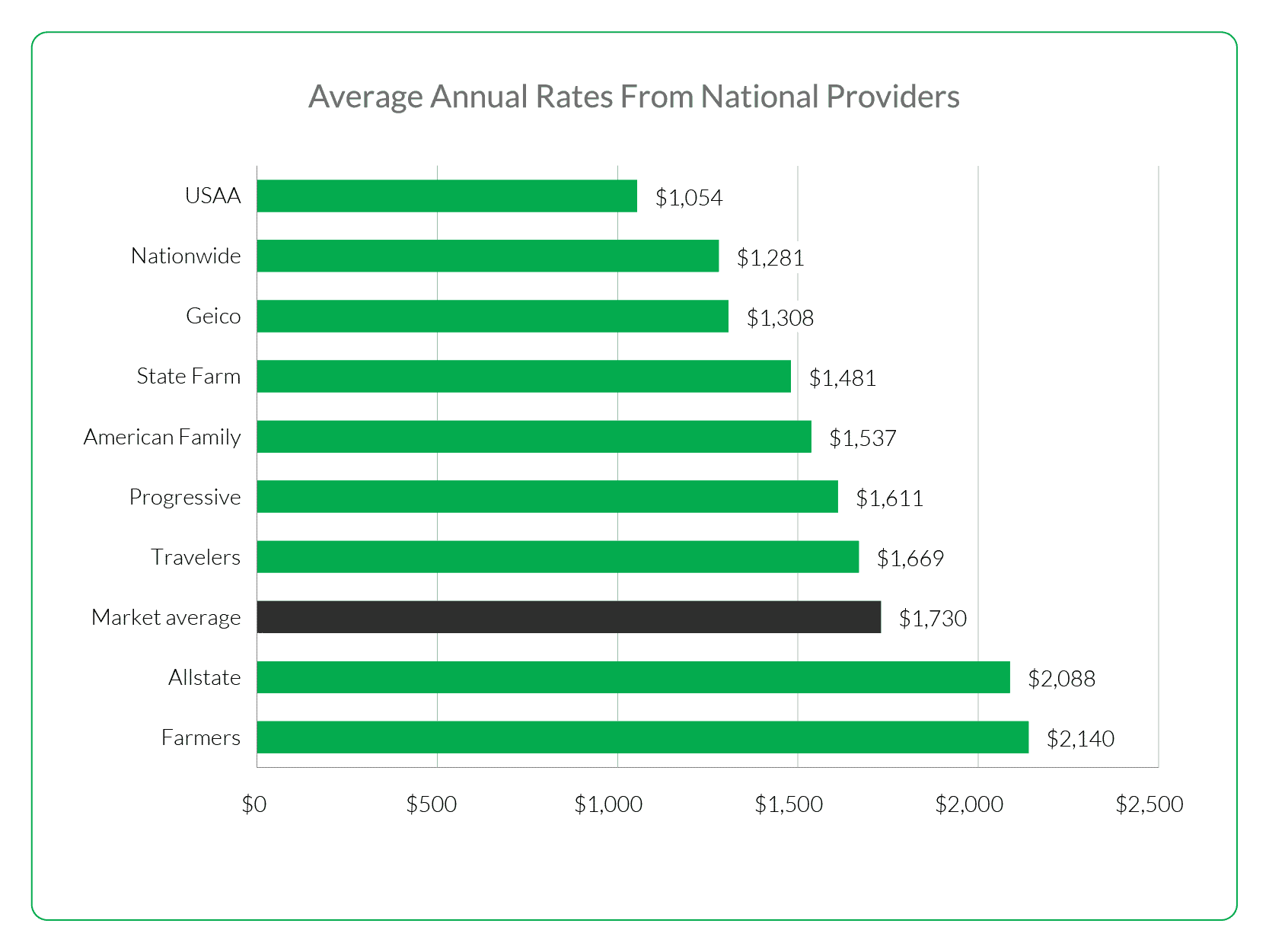

It is possible to save money by shopping around for insurance companies with lower rates. You should know that your homeowners insurance rate may change each year because of inflation and changes to the value of your home.

Regularly review your policy to keep abreast of any premium increases.

Most insurance companies will add small rate increases every year when renewing their policies, but over time they can add to a significant amount.

Increase your deductibles for lower monthly payments.

The higher the deductible, the lower the out-of pocket cost if you have an accident at your house and the greater the likelihood that you will not need to make a claim.

Installing security features, fire alarms, and other safety devices can help you reduce your claim risk.

You should buy enough homeowners' insurance to cover the cost of replacing your home and its contents in case it is damaged.

Industry experts say the amount of insurance that you should buy for your homeowners policy depends on how much it would cost to replace your home, including its contents. You should also have enough to cover any outbuildings you own, such as a garage or shed.

Your agent will help you to determine the level of coverage needed to give you peace ofmind in case of loss.

You should have a dwelling coverage amount equal to what it would cost to rebuild your house using local labor and material costs.

In addition, you should have enough to cover your personal belongings such as furniture and clothing.

Don't underestimate the importance of this step, as two-thirds of American homes are underinsured, a problem that can cause unexpectedly high repair and replacement costs after a disaster.

Buying homeowners insurance isn't easy, but it can be a smart investment in your future. This insurance helps protect your biggest asset, and it can help cover the cost of renting a temporary house while you rebuild your own.