Homeowners' insurance is essential for all homeowners in Mississippi. It protects your property and can help you recover financially from losses caused by fires, burglaries or natural disasters. In addition to providing peace ofmind, the right homeowners insurance plan can protect you against unforeseeable financial risks.

Average Homeowners Insurance costs in Mississippi

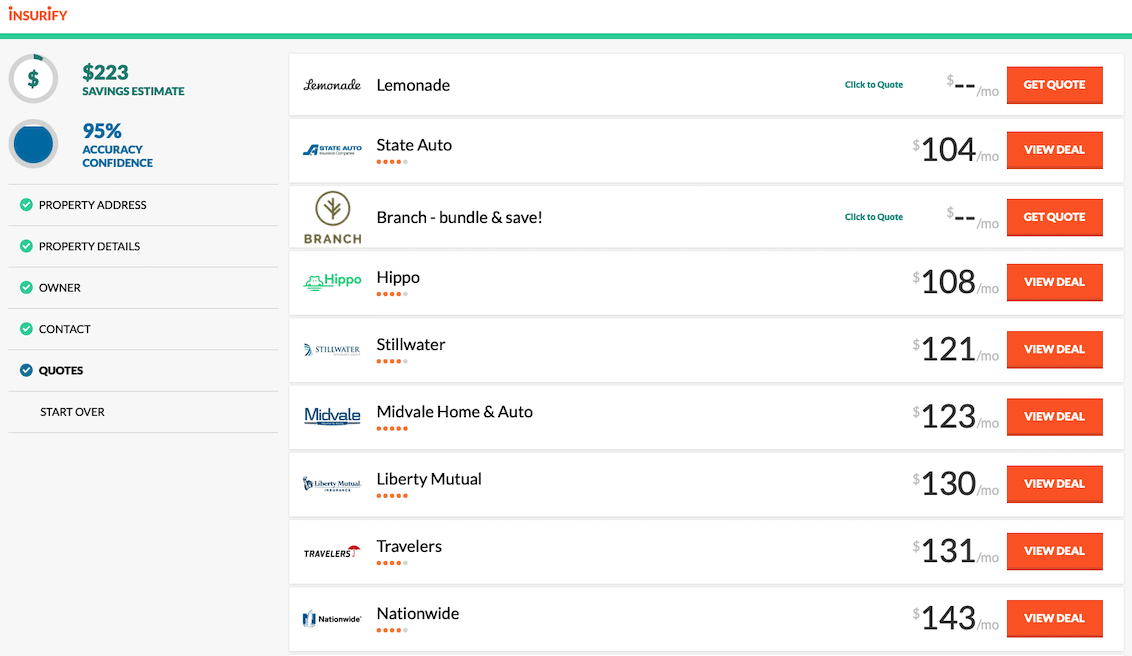

Home insurance in Mississippi is affected by many factors. The type of house you live in, as well as your age, will affect the cost of the insurance policy. Comparing the quotes of at least three companies can help you get the best deal for your budget.

Best Homeowners Insurance Mississippi

Safeco has the lowest homeowners insurance rates in Mississippi. The average annual premium for a home worth $200,000 is $1,564. Southern Farm Bureau is another company that offers affordable coverage in the state. They offer home, auto and flood insurance. They have great customer service ratings and a low rate of complaints.

Many homeowners policies in Mississippi include an optional deductible, which you can pay from your own pocket before the insurance company pays out the claim. This can save you money in the long run by keeping your annual premiums lower and preventing you from having to shell out a large sum of cash on a single claim.

Selecting the correct deductible is essential for home insurance. This will affect how much out-of pocket you pay in case of loss. A higher deductible will lower your insurance premium, but it'll also mean you have to pay a larger amount out-of-pocket if there is a claim.

Clearsurance Homeowners Insurance Ratings in Mississippi

The best way to find the right home insurance provider is by comparing and analyzing the options that are available. It is best to check customer reviews and rating to get a feel for a firm's quality. This can be done by visiting J.D. Power's ratings of insurers or the National Association of Insurance Commissioners complaint ratios.

What to look for in an insurance company that offers home coverage

The best companies offer high-quality services and products, along with excellent customer ratings. These companies can also help you save money by offering discounts, such as bundling your auto and home insurance with one provider.

It is also important to consider how a company manages its claims. Some companies offer a vast network of agents. Others may provide online customer support, a mobile application for tracking claims and an app to file and track them.

How much coverage is needed for home insurance?

Answering this question will depend on many factors. These include the type of home you own, the risk profile that you carry, and the size of the policy. Take into consideration any specific risks that may affect your home, such as hurricanes and tornadoes.