Homeowners' insurance is an important policy to protect your house and personal possessions in the case of theft or damages. If you are forced to relocate due to a catastrophe or another covered loss, the right policy will help cover your additional living expenses. This is why it's important to consider your needs and choose a homeowners policy that fits your unique situation.

Best Home Insurance Companies of Oregon

It is important to choose an insurance provider who offers you the coverages that you need, at a cost you can afford. MoneyGeek has compared top home insurers in Oregon based on affordability, experience with claims, customer satisfaction, and financial stability.

American Family won the highest score for its overall service and affordability. Country Financial and Farmers came in second and third place respectively. If you're looking for a policy, or switching companies, these companies have a range of coverages to fit your needs.

Country Financial provides a special optional earthquake insurance option that can help protect your home, possessions, and family from natural disasters. However, the coverage may not be offered in all areas.

Compare quotes from different insurance companies to find the best policy for you. Work with your agent to make sure that you get enough coverage. If you need more coverage than what's offered by your current policy, talk to your agent about increasing the limits on your Oregon home insurance.

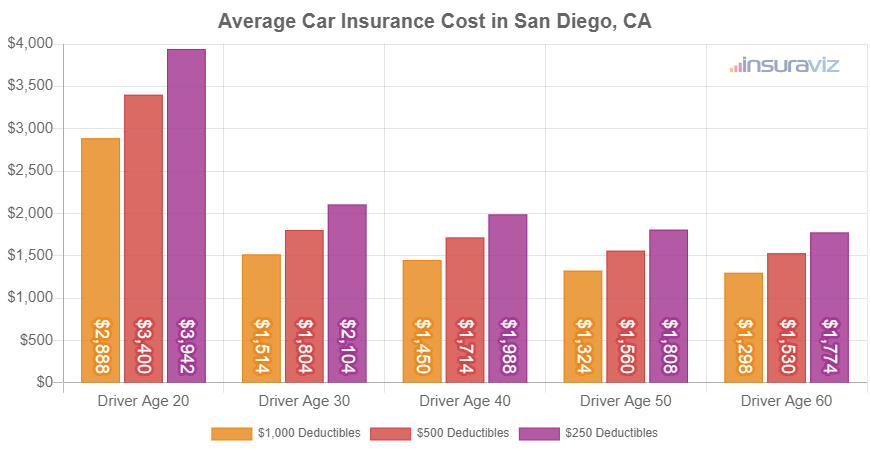

What is the Best Deductible?

The amount you have to pay for a homeowners claim will be affected by the deductible. It's best to set a deductible that you can comfortably afford and is within your budget.

If your home is considered a high-risk property by insurance companies, you may see a higher than normal deductible on your policy. In many cases, your deductible will be lower if you take advantage of discounts or other incentives.

Take advantage of discounts to save money on your homeowners insurance. Some of these can be as low as 5 percent of your premium. However, they could save hundreds of pounds over time.

Your rate can be affected by credit checks

In a highly competitive market, it is crucial to have a positive credit rating. Good credit will help you get a cheaper policy rate, as lenders consider you a responsible customer who pays on time and manages their finances well.

Most Oregon homeowners' insurance companies will also run a credit report before they approve your policy. They do this to determine if you're capable of paying a claim if one occurs.

How to Get the Lowest Homeowners Insurance in Oregon

Oregon homeowners insurance is cheaper than the average national cost, making it easy to find one that fits your budget. To learn more about ways to reduce your premium, you should speak to your local insurance agent.