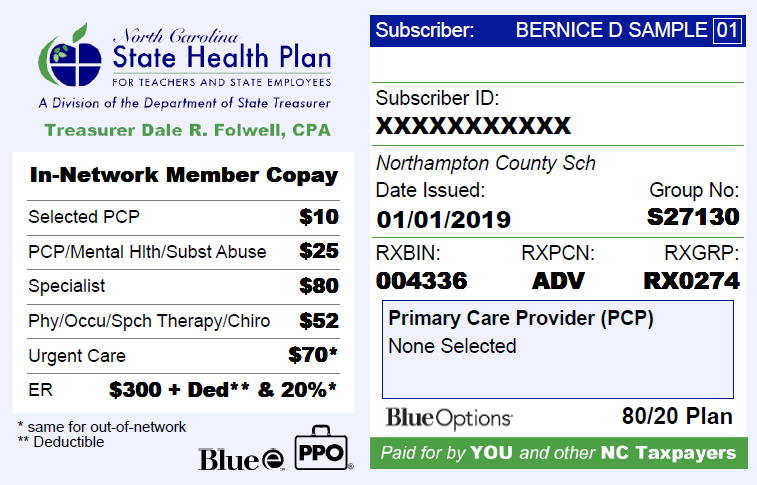

In an effort to determine the average home insurance cost in Michigan, MoneyGeek analyzed quotes from the six most popular insurance companies in the state. The state's ZIP codes are used to calculate the quotes. The average home includes a $250,000 dwelling coverage value, $100,000 in liability coverage, and $100,000 in personal property coverage.

Protection class determines average home insurance cost

Average home insurance costs in Michigan depend on the protection class of your home. The protection class is a rating system of 1-10 that measures your likelihood of fire damage. It also depends on the distance from a fire station or water supply. These protective measures are farther away from your home, so it's more likely that your home will be damaged by a fire.

Age of the home

In determining the cost of home insurance, it is important to consider your house's age. In Michigan, home insurance rates can vary greatly depending on the age and size of your house. Flood-prone areas of Michigan may be more than others. Also, larger cities like Detroit are known for having higher crime rates. Still, it is possible to save money on home insurance if you shop around. It is important to understand the differences between coverages and their costs, as well as how to get discounts.

Localization

Michigan's average home insurance cost varies depending upon the type of coverage required and where it is located. In Michigan, a home built in 2000 costs $638 per year less to insure than one built in 2015. The difference is not significant but it is noticeable.

Fire hazard

There are many factors that influence the cost of homeowner’s policy. The distance between your home and the nearest fire department or fire station, for instance, will determine the protection class you receive. Also, the distance from your home to work or school will have an impact on your premiums.

Personal liability coverage

You might want to look at the different ZIP codes to see how they compare homeowners insurance costs in Michigan. Michigan homeowners pay on average $1,292 a year for $250,000 in dwelling coverage, which is 7% less than the national average. Farmers, Allstate and State Farm are some of Michigan's top home insurers.